SA302 & Tax Year Overview Download Checklist

If you’re self-employed or receive income from rental properties, you will need to prove your income using your Self Assessment Tax Calculation (SA302) and Tax Year Overview.

If you have an accountant they should be able to provide you with these documents.

However, if you file your own tax returns this guide takes you through the steps you need to download the correct documents.

Before You Start

- Have your Government Gateway login ready

- Ensure your Self Assessment return is submitted

- If you’ve only just submitted your tax return you’ll need to wait 72 hours after submission for documents to be available

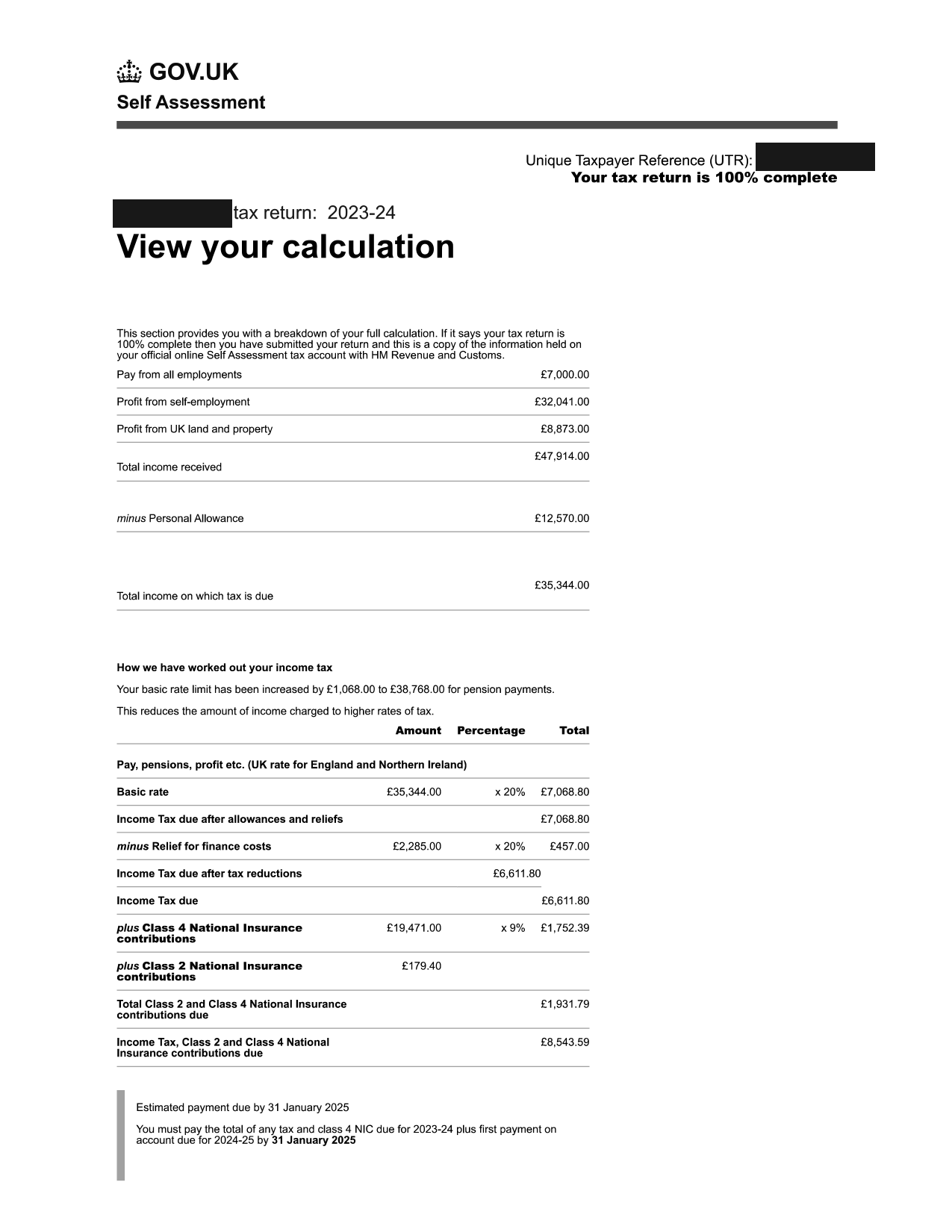

Download SA302 Tax Calculation

- Go to HMRC SA302 page

- Log in with your Government Gateway credentials

- Click ‘Self Assessment’

- Click ‘More details about your Self Assessment returns and payments’

- Scroll to ‘Previously filed returns’

- Click ‘Get your SA302 tax calculation’

- Click ‘Continue to your SA302’

- Click ‘View your Calculation’

- Click ‘View and print your calculation’

- Save as PDF (Example below)

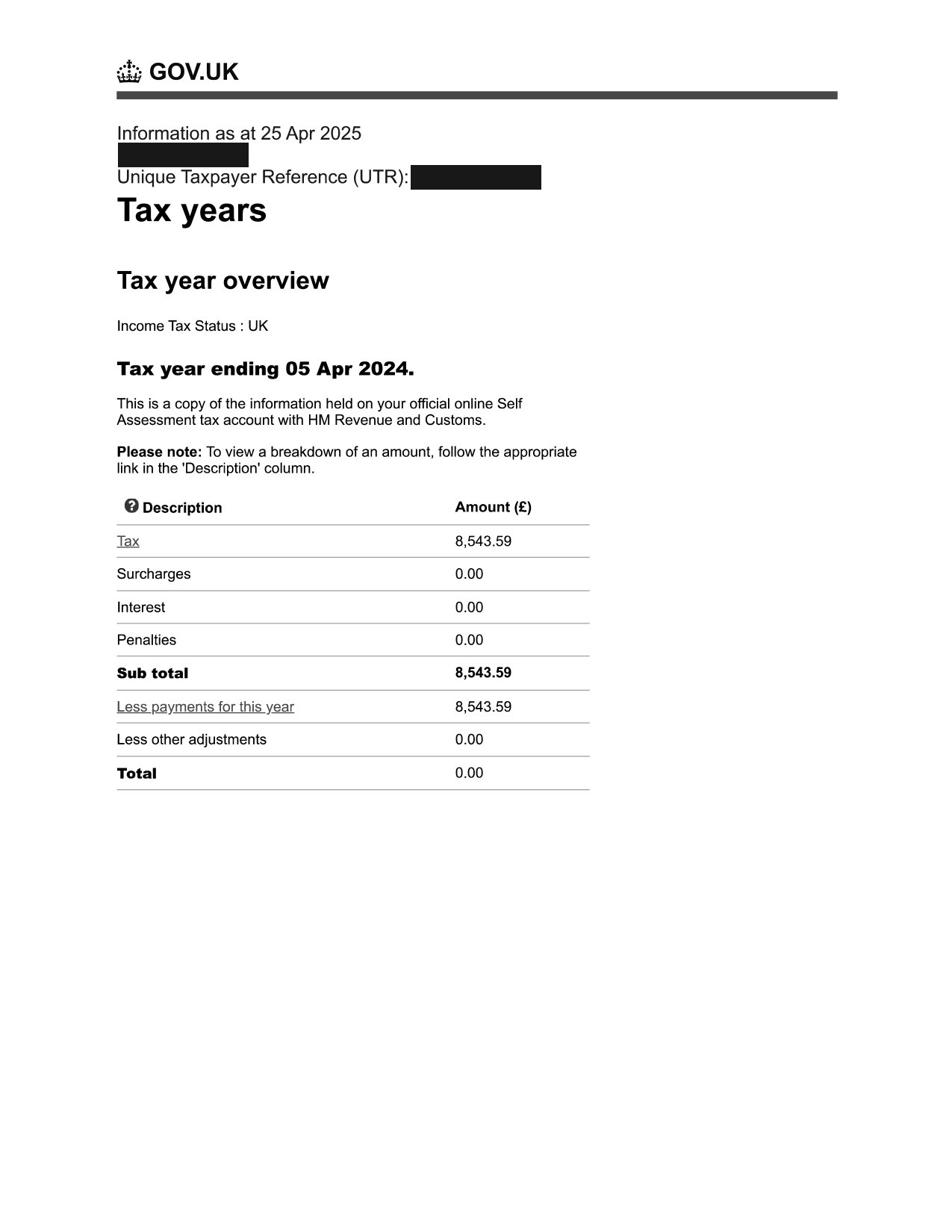

Download Tax Year Overview

- Return to Self Assessment section

- Click ‘View Self Assessment return’

- Select the relevant tax year

- Click ‘Go’

- Scroll to ‘Print your tax year overview’

- Save as PDF (Example below)

Notes

- Lenders will need to see a minimum of the latest 2 years

- The date of the latest year needs to be no less than 18 months ago

Below are examples of the documents you are looking for: